The Art of Retirement

This well-written, comprehensive guide by a financial planner paints retirement in a new light.

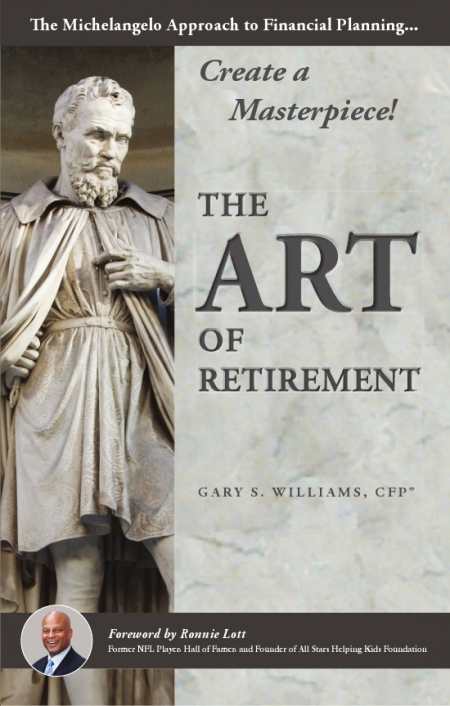

The key difference between Gary Williams’ engaging book about retirement and so many others written on the subject is the author’s perspective: He believes that to enjoy retirement, everyone must create a life that is a “masterpiece.” Williams points to Michelangelo as a prime example of an artist who, “created masterpieces, but also understood that his own life was a masterpiece and, at the same time, a work in progress.”

Williams uses the art metaphor effectively throughout The Art of Retirement, which is divided into two distinct sections: “Creating Your Masterpiece” and “The Art of Investing.” In the first part, Williams writes eloquently about making choices in life and maintaining perspective. He doles out insightful advice about finding a purpose in retirement, acknowledging that as much as fifty percent of prospective retirees plan to continue working in retirement. “The key,” Williams advises, “is to retire to something, not from something.”

One of the more interesting topics in the first part of the book is something the author calls “legacy planning.” With a great deal of sensitivity, he discusses leaving a legacy in the broadest sense, not just financially, but spiritually. The notion of passing along one’s sense of values to future generations is rarely addressed in a book whose primary focus is investing. For this, the author deserves credit. Williams, a certified financial planner, closes the first part of the book with an excellent chapter offering several helpful “rules of thumb” that helps guide the reader in financially planning for retirement, along with an objective discussion of why and how to choose a financial planner.

The second part of the book is not unlike other financially focused retirement books. Williams provides a detailed discussion of financial concepts, such as risk and diversification, and he offers his own analysis of how to invest in turbulent economic times. While this section contains information commonly found elsewhere, Williams’ presentation of the material is what sets his book apart. The author’s ability to express complex ideas in simple terms is impressive. He writes well and makes even dry facts seem interesting. He wisely continues to employ the art metaphor as a way of anchoring the content to a central concept.

The text is augmented with charts and graphs, each carefully explained. Subheads, bullets, and highlighted text are used judiciously to facilitate reading. Throughout each chapter, Williams calls out “key points” with boxed-in text, aiding in scanning and comprehension. At the end of the book, the author includes a helpful dictionary of definitions, as well as several useful tools, such as a “retirement vision questionnaire” and a budget template to document income and expenses.

Williams has done a masterful job of presenting an elegantly constructed, comprehensive, unbiased view of what readers need to think about, personally and financially, as they head toward retirement. The fact that the author intends to donate 100 percent of the profits from the book to charitable causes further reinforces his character and credibility. This is a book that should prove valuable to anyone approaching retirement.

Reviewed by

Barry Silverstein

Disclosure: This article is not an endorsement, but a review. The publisher of this book provided free copies of the book and paid a small fee to have their book reviewed by a professional reviewer. Foreword Reviews and Clarion Reviews make no guarantee that the publisher will receive a positive review. Foreword Magazine, Inc. is disclosing this in accordance with the Federal Trade Commission’s 16 CFR, Part 255.