Index Funds

The 12-Step Recovery Program for Active Investors

Smart, precise, and funny, Index Funds makes understanding the market sensible and even desirable.

Today it’s hard to know where to turn for investment advice. Fortunately, Mark T. Hebner’s Index Funds: The 12-Step Recovery Program for Active Investors offers educated insight—with lots of research and a touch of humor—into today’s investor arena.

Hebner’s 12-Step Program is meant as a way to assist people with problems. In this case it’s active investors or speculators that have tried to predict market activity to make killer returns and have lost out financially. By contrast, via his self-constructed program, Hebner shows how investing in index funds is a safer, more secure way to invest money to see realistic long-term returns.

The author does not act like a guru. His information is clearly researched, right from his definition of index funds and passive investing: a strategy of investing carefully in a diversified portfolio of longstanding stocks and bonds. It makes reference and pays respect to the great money market theorists, from Friedrich von Hayek and Benjamin Graham up to Warren Buffett, Merton Miller, and Eugene Fama. He compiles studies from these famous experts, noting that active stock picking is really a finding-a-needle-in-a-haystack venture. Investors need to subject their managers to the industry T-score to see if they are good at making investment choices.

Hebner also returns to a central thesis throughout the book: that no one, no matter how great his or her track record is, can truly predict market activity to pick stocks. His examination of “time picking” in step 4 shows that those that claim to pick stocks at the right time are usually riding on luck, and that truly great investing depends on, as step 9 says, analyzing “historical data over eighty years … to provide a more reliable estimate of risks and returns.”

While some books on business advice and understanding marketplaces are often dry and laden with industry jargon, Hebner infuses Index Funds with easy-to-understand explanations of how to invest with index funds. The prose breaks down all the terms of investing—“riskese,” “time picking,” etc.—with short descriptions complete with helpful charts and infographics.

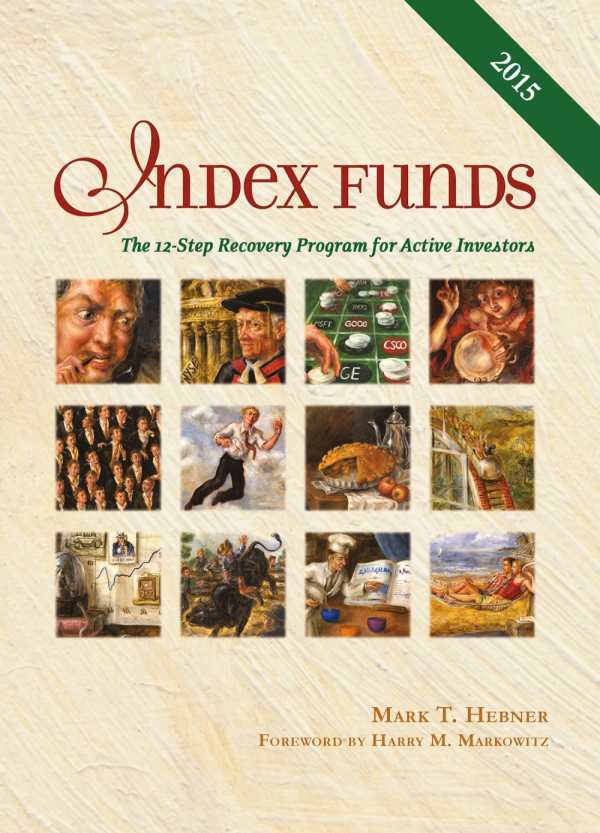

Thanks to artist Lala Ragimov, whose renditions of Flemish Baroque and Venetian Renaissance style paintings include investor caricatures, Index Funds also has outright humor that, again, helps explain each concept chapter by chapter.

Smart, precise, and funny, Index Funds makes understanding the market sensible and even desirable.

Reviewed by

James Burt

Disclosure: This article is not an endorsement, but a review. The publisher of this book provided free copies of the book and paid a small fee to have their book reviewed by a professional reviewer. Foreword Reviews and Clarion Reviews make no guarantee that the publisher will receive a positive review. Foreword Magazine, Inc. is disclosing this in accordance with the Federal Trade Commission’s 16 CFR, Part 255.