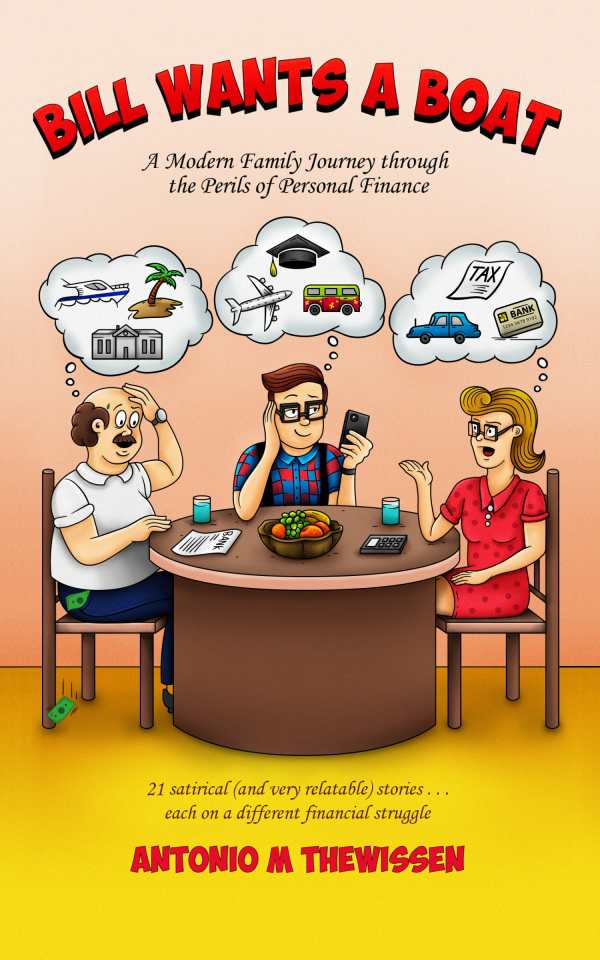

Bill Wants a Boat

A Modern Family Journey Through the Perils of Personal Finance

Bill Wants a Boat is an attention-grabbing personal finance primer for those striving to secure their financial futures.

Antonio M. Thewissen’s financial parable Bill Wants a Boat follows a couple’s monetary struggles during their home stretch to retirement and as they set their teenage son up for a lifetime of success.

Inspired by real-world people and their experiences, the stories in this book focus on Bill Shillington and his family. Bill is an electrician whose dreams are often bigger than his budget. His wife Penny, an accountant, is focused on achieving a secure financial future. Their spending-savvy son Florin contributes tech tips to make budgeting easier, and Penny helps Bill avoid money mistakes like relying on credit cards to fund nonessential purchases or taking out a car loan with rock-bottom payments and astronomical interest rates.

The book holds interest because it focuses on family life rather than imparting strict financial jargon. Twenty-one short, fictional anecdotes make the motivations of an everyman like Bill easy to understand and identify with; anyone who has cast an envious eye toward the new boat docked in their neighbor’s driveway will sympathize with the lessons he learns. At the same time, Florin and Penny’s practical advice is couched in a way that puts the family’s financial best interests in mind.

The stories are all entertaining and all deliver their points with clarity. While most of the book’s vignettes focus on fundamental financial concepts and lessons, a handful delve into more complex issues like annuities and IRS income brackets and deductions. For each lesson, clever titles and bullet-pointed lists that summarize “Penny’s Pointers” are easy ways to identify key takeaways. Each story is only a few pages long, making learning a little about sometimes-complicated concepts both possible and palatable, even for those who are just learning the basics of spending and saving.

Footnotes provide deeper definitions of the technical terms covered in the family’s financial stories, imparting additional information without slowing the flow. Recommended websites, including ConsumerFinance.gov, are also pointed to. Credibility is further established by Thewissen’s background in selling credit cards while working for a bank.

With stories that will be all too familiar to those who have struggled to decipher credit card statements or auto lease agreements, Bill Wants a Boat is an attention-grabbing personal finance primer for those striving to secure their financial futures.

Reviewed by

Charlene Oldham

Disclosure: This article is not an endorsement, but a review. The publisher of this book provided free copies of the book and paid a small fee to have their book reviewed by a professional reviewer. Foreword Reviews and Clarion Reviews make no guarantee that the publisher will receive a positive review. Foreword Magazine, Inc. is disclosing this in accordance with the Federal Trade Commission’s 16 CFR, Part 255.