The Last Train of Wealth

AI Narratives and Real Estate Digitalization---A Complete Forecast of Stock Price and Political Economy Resonance

Using storytelling in the place of broad analysis, The Last Train of Wealth is an ambitious economic survey.

A speculative economic treatise, The Last Train of Wealth advances a cursory vision of how artificial intelligence, property markets, and political storytelling will converge to shape global finance.

Straddling economics, technology studies, and political commentary, this pamphlet-length book sets out to explain how narratives rewrite the distribution of wealth. Its central case study is Opendoor, the US-listed real estate platform; Opendoor is offered as a symbol of future property digitization. Around this example, the work constructs a broad interpretive frame linking the evolution of digital assets, shifts in US monetary policy, and twentieth-century political movements. Its stated aim is to develop a logic framework for understanding how emotion, power, and institutional language shape market outcomes over the course of decades.

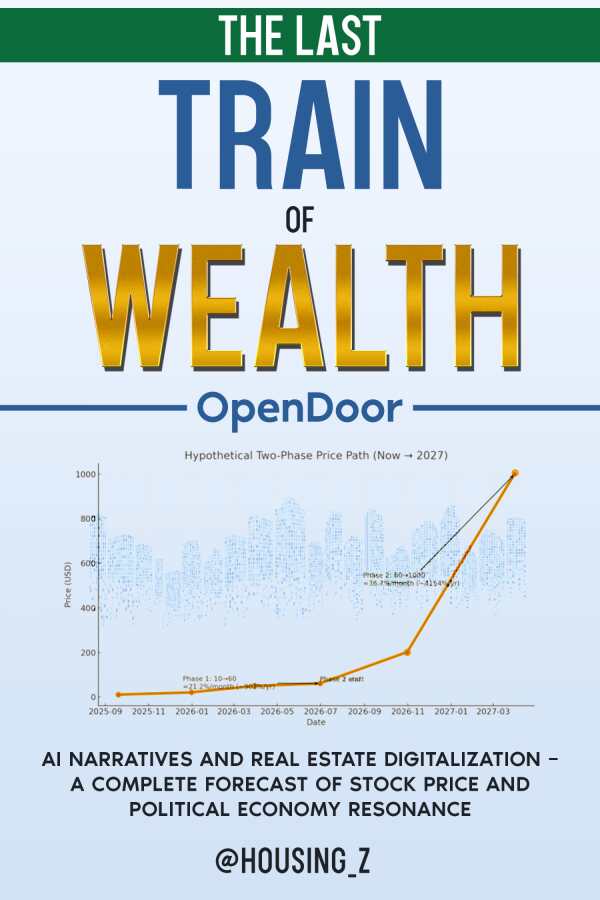

Arranged in four parts, the book’s central argument is that the credibility of the US dollar depends on a new form of digital collateralization, with real estate providing the most universal and comprehensible asset base. According to this theory, artificial intelligence and blockchain technology can be used to rebuild financial trust. The text supports this argument with a historical comparison of Opendoor’s growth to the rise of the Chinese Communist Party (CCP), paralleling the two to highlight the idea that changes in narrative legitimacy, whether in politics or markets, precede the structural redistribution of wealth. Tables, charts, and timelines are also used to align company events to revolutionary milestones.

Its conceptual vision bold, the book presents finance as a narrative art form. In doing so, it adopts a unique rhetorical flair, arguing that economic outcomes follow belief systems and suggesting that the psychology of confidence might outlast, and thus be more valuable than, data. However, its combination of corporate commentary, geopolitical speculation, and pseudoscience blurs its boundaries too much, often at the expense of clarity. In presenting its arguments as inevitabilities and preferencing the CCP-Opendoor analogy to the exclusion of other illustrations, it proffers few true historical and economic insights.

The prose is declarative but undermined by a tendency toward sloganizing, alternating between brief policy expositions and compressed rhetoric, as in statements comparing computer chips to the printing press. Elsewhere, the book claims that Opendoor will become the industry’s price anchor. Throughout, it works to marry the drama of global finance with cross-disciplinary ambition, but its successes on these fronts are limited.

The book also includes an abbreviated account of capital networks, proposing that particular people and trading institutions have made coordinated efforts to realign US property finance. The Trump family is also presented as a background force, with their involvement inferred from policy language anomalies and coincidental rhetoric and events, as with figures from these differing worlds appearing together in social media photographs. The results are unconvincing.

Also complicating the work’s delivery is its pervasive use of undefined acronyms including CCP, ETF, and NFT, and its inclusion of untranslated Chinese characters. Its occasional typographical errors are distracting, as with its misplaced speech marks and the substitution of “compute” for “computer.” The excessive use of bullet-point lists further underscores its limitations.

An energetic economic thought experiment, The Last Train of Wealth extends narrative economics into the territory of speculative prophecy.

Reviewed by

pine breaks

Disclosure: This article is not an endorsement, but a review. The publisher of this book provided free copies of the book and paid a small fee to have their book reviewed by a professional reviewer. Foreword Reviews and Clarion Reviews make no guarantee that the publisher will receive a positive review. Foreword Magazine, Inc. is disclosing this in accordance with the Federal Trade Commission’s 16 CFR, Part 255.